income tax rate indonesia

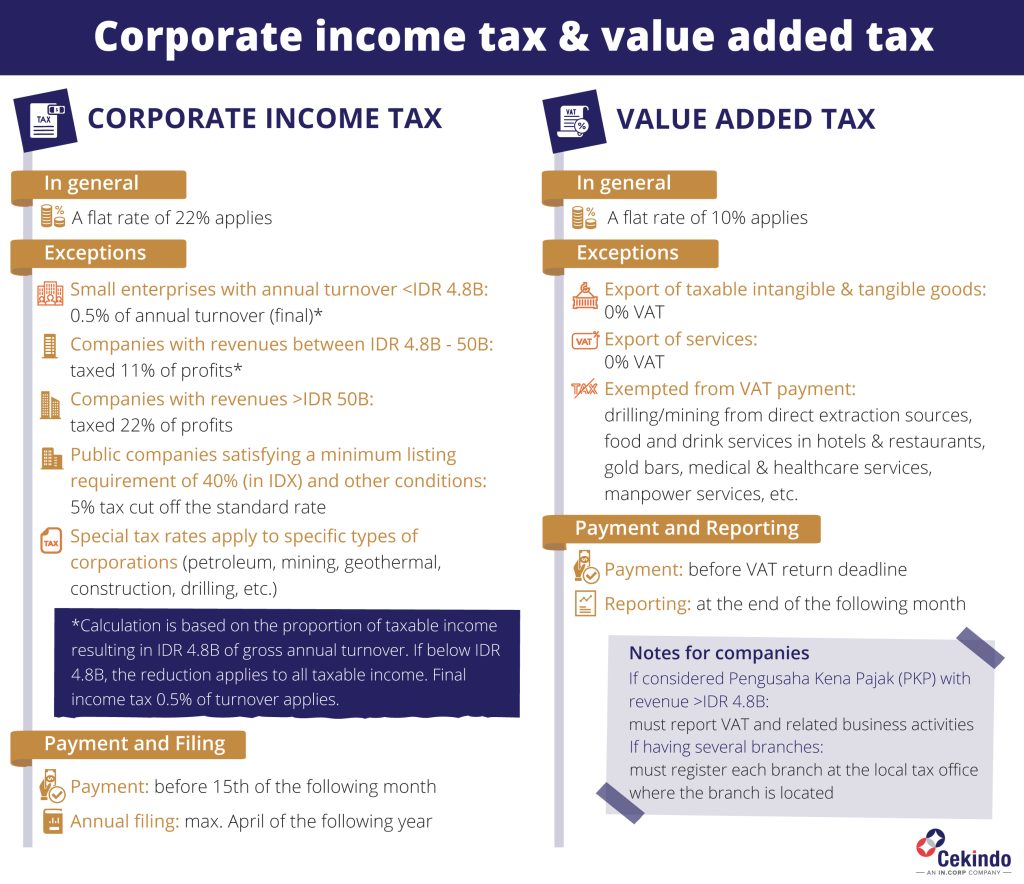

The government regulation Peraturan Pemerintah 232018 PP-23 effective from July 2018 reduced the income tax rate in Indonesia to 05 from the previous 1. Generally the VAT rate is 10 percent in Indonesia.

Personal Income Tax In Indonesia For Expatriate Workers Explained

Salary range per annum.

. Review the 2020 Indonesia income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other. Tax rates range from 5 to 35. Personal Income Tax Rate in Indonesia averaged 3158 percent from 2004 until 2022 reaching an all time high of 35 percent.

The Personal Income Tax Rate in Indonesia stands at 35 percent. However the exact rate may be increased or decreased to 15 percent or 5 percent according to. The following tax rates can be used as your basic guidance to calculate how much income tax that you have to pay for.

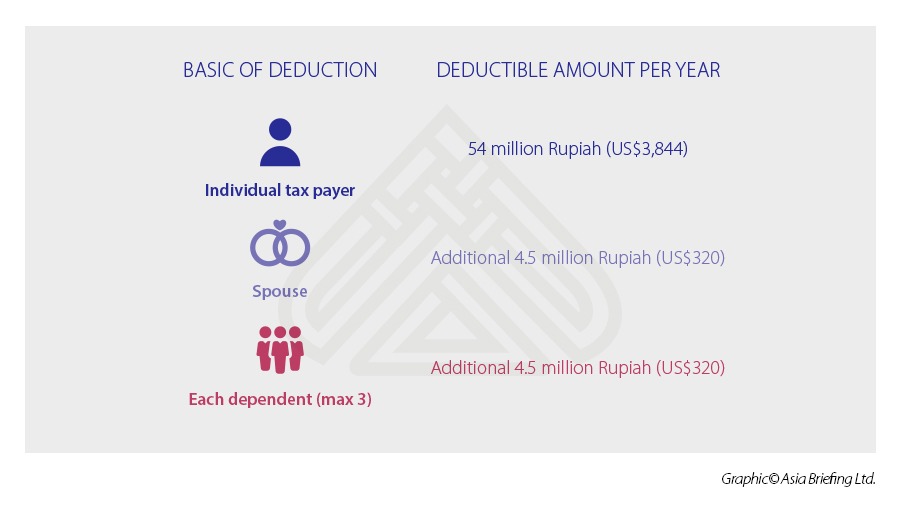

Indonesia Income Tax Rates and Personal Allowances. Corporate taxpayers with an annual turnover of not more than 50 billion rupiah IDR are entitled to a 50 tax discount of. Refer to the following table for the tax rates in Indonesia.

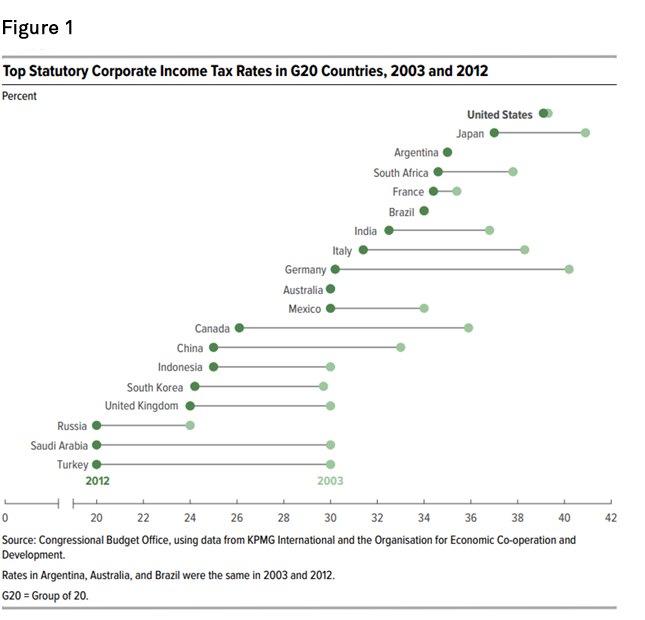

Normal rate of taxation in Indonesia corporate income is 25. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. The changes include a.

Review the 2021 Indonesia income tax rates and thresholds to allow calculation of salary after tax in 2021 when factoring in health insurance contributions pension contributions and other. This means that the higher the income generated the higher the tax rates are. 4 Indonesian Pocket Tax Book 2022 PwC Indonesia Corporate Income Tax Taxation on certain offshore income Indonesian tax residents are generally taxed on a worldwide income basis.

The Personal Income Tax Rate in Indonesia stands at 35 percent. New Progressive Income Tax Rates for 2022 07 Jan 22 From January 2022 new progressive income tax rates come into effect in Indonesia. Review the latest income tax rates thresholds and personal allowances in Indonesia which are used to calculate salary after tax.

Personal Income Tax Rate in Indonesia averaged 3158 percent from 2004 until 2022 reaching an all time high of 35 percent. Small company discount. Companies that put a minimum of 40 of their shares to the public and are listed in the Indonesia Stock Exchange offer are taxed.

Layer Added Income Above Idr 5 Billion Is A Subject To 35 Income Tax Rate

All You Need To Know About The New Income Tax Rate In Indonesia Emerhub

Personal Income Tax In Indonesia Paul Hype Page

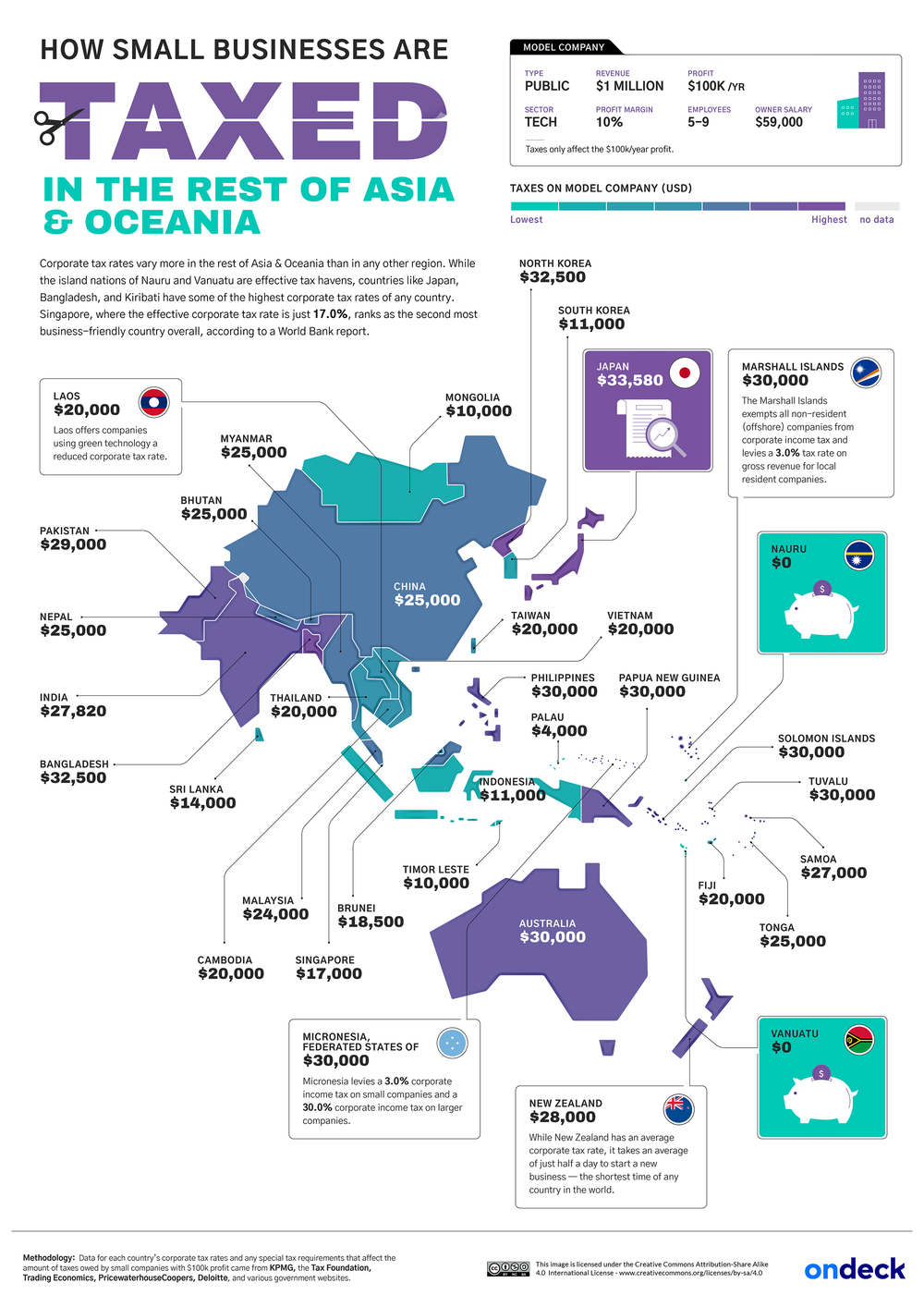

Taxes On Small Businesses Across The Globe Mapped See Where Rates Are High Low And Nonexistent

Guinea Sales Tax Rate Vat 2022 Data 2023 Forecast 2014 2021 Historical Chart

Indonesia Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Tax Consultant Indonesia For 100 Compliance In Tax And Payroll

Taxation In New Zealand Wikipedia

Annual Individual Income Tax Report Binus Expatriate Indonesia

Guide To Taxes In Indonesia Brackets Incentives Asean Up

Government Plans A 2020 Reform For Expat Taxation In Indonesia

Competitiveness Impact Of Tax Reform For The United States Tax Foundation

Why Indonesian Are Less Innovative The Role Of Tax Institution In Innovation Economics Accounting And Taxation Ecountax Com

Christian Christensen On Twitter Swedish Tax Rate In Context Someone On 100k Year In Sweden Would Pay Following In Tax 2 020 To 50 400 Pay 32 15 480 50 400 To 72 500 32 20

Indonesia Sets Out Tax Plan With New Income Bracket Amnesty Bloomberg

Should Indonesia Lower Income Tax Rates Opinion The Jakarta Post

How Tax Reform Will Grow Our Economy And Create Jobs A Testimony To The U S House Of Representatives S P Global