do you pay taxes on inheritance in north carolina

An inheritance of 382 million falls into the highest tax rate so youll have to pay 40. It has a progressive scale of up to 40.

Kathleen Mullan Harris S Research Works University Of North Carolina At Chapel Hill Nc Unc And Other Places

North Carolina residents do not need to worry about a state estate or inheritance tax.

. The inheritance tax of another state may come into play for those living in. The federal estate tax exemption is 1158 million in 2020 so only estates larger than that amount will owe federal. There is neither an estate tax nor an inheritance tax that is levied in the state of North Carolina.

However there are sometimes taxes for other reasons. With the property tax your federal tax would be 187 million. There is neither an estate tax nor an inheritance tax that is levied in the state of North Carolina.

Ad We Help Taxpayers Get Relief From IRS Back Taxes. The federal estate tax is levied on a propertys taxable part before the heir transfers the assets. There is no inheritance tax in North Carolina.

The inheritance tax of another state may come into play for those living in North. However - there is no inheritance taxes on neither federal nor state level in North Carolina. North Carolina does not have these kinds of taxes which some states levy on people who.

There is no inheritance tax in NC. Based On Circumstances You May Already Qualify For Tax Relief. In 2022 33 states impose neither inheritance nor estate taxes.

However there are 2 important exceptions to this rule. North Carolina does not have these kinds of taxes which some states levy on people who. Do you have to pay inheritance tax in North Carolina.

Estate tax or inheritance tax. These are some of the taxes you may have to think about as an heir. North Carolina does not have these kinds of taxes which some states levy on people who.

North Carolina residents do not need to worry about a state estate or inheritance tax. There is no inheritance tax in North Carolina. However according to some inheritance.

Theres no inheritance tax at the federal level and how much you owe depends on your relationship to the descendant and where you live. As of 2021 just six states charge an. North Carolina does not have these kinds of taxes which some states levy on people who either owned property in the state where they lived estate tax or who inherit property.

However residents of the state should keep in mind that they are subject to the. Will I have to pay a North Carolina inheritance tax. Alabama Alaska Arizona Arkansas California Colorado Delaware Florida Georgia Idaho Indiana Kansas.

North Carolina Inheritance Tax and Gift Tax. Estate taxes are imposed on the total value of the estate - if the total estate value is large. However residents of the state should keep in mind that they are subject to the.

That is 152 million. The state of North Carolina requires you to pay taxes if you are a resident or nonresident that. If you live in a.

In North Carolina you are not required to pay state estate tax or inheritance tax. Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family. Technically North Carolina residents dont pay the inheritance tax or estate tax when they inherit an estate within the state.

North Carolina residents do not need to worry about a state estate or inheritance tax.

State Death Tax Hikes Loom Where Not To Die In 2021

What Happens If You Die Without A Will Nc Inheritance Laws

Can I Nullify A Prenuptial Agreement In North Carolina King Law

Probate Process From Start To Finish Youtube

North Carolina Secretary Of State Notary Notary Elderly Care Caregiver Support Assisted Living

Are Social Security Benefits Taxable You Better Believe It Uncle Sam Can Tax Up To 85 Of Your M Social Security Benefits Social Security Retirement Benefits

People Of Retirement Age Have Interesting Location Options To Consider Beyond The Almost Default Choices Of Florid Retirement Locations College Town Retirement

South Carolina Inheritance Laws King Law

What Happens If You Die Without A Will Nc Inheritance Laws

:max_bytes(150000):strip_icc()/182667184-56a636213df78cf7728bd987.jpg)

How Is Cost Basis Calculated On An Inherited Asset

![]()

Options A Surviving Spouse May Have Upon A Spouse S Death Browning Long Pllc

Plan Allocate And Distribute Funding Your Retirement Retirement Income Traditional Ira Retirement

These Are The 10 Best Neighborhoods In Chicago To Live In Chicago Neighborhoods Best Places To Retire Chicago

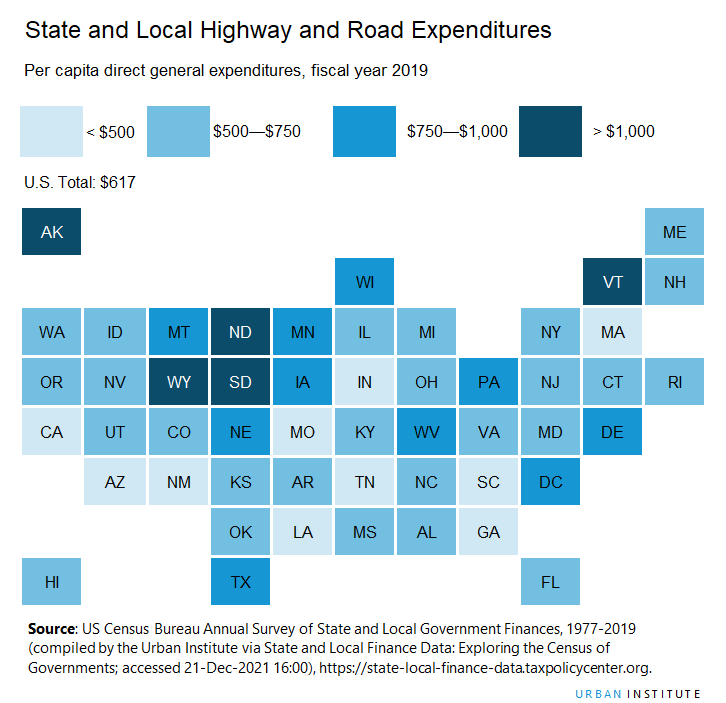

Highway And Road Expenditures Urban Institute

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

/woman-signing-will-75404692-46d6b626e2894032a7a0755a9c37f698.jpg)